Accounting

In this Accounting course, students will explore accounting, including investigating accounting careers. Students will learn basic accounting skills and procedures, both with and without a computer, for general journals, general ledgers, cash payments journals, cash receipts journals, sales journals, accounts payable ledgers, and accounts receivable ledgers. Students will also learn how to reconcile a bank statement and to prepare payroll records. This course covers the basic principles of financial accounting for individuals and for companies with attention to both the mathematical formulas and to the ethical side of accounting.

Major Topics and Concepts

Finding the Right Career

The Business Environment

The Accounting System

Accounting & Computers – Introduction

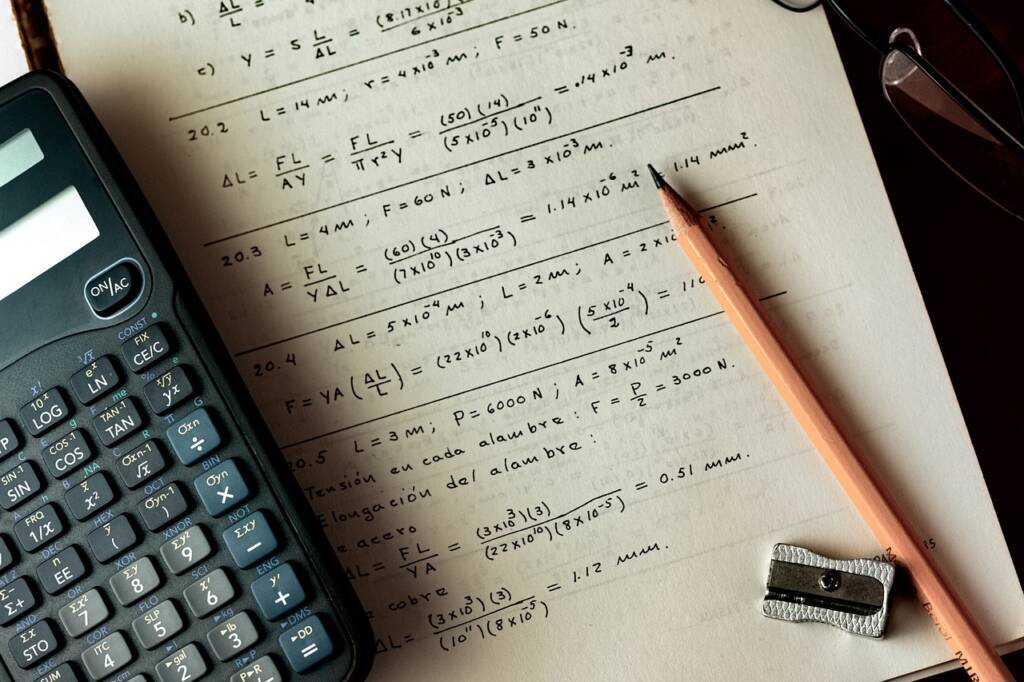

Accounting & Computers – Formulas

Beginning the Accounting Cycle

Property and Financial Claims

Transactions that Affect an Owner’s Investment, Cash, and Credit

Transactions That Affect Revenue, Expenses, and Withdrawals by the Owner

The Double Entry Accounting System

Applying the Rules of Debit and Credit

Relationship of Revenue, Expenses, and Withdrawals to Owner’s Equity

Applying the Rules of Debit and Credit to Revenues, Expenses, and Withdrawal Transactions

Recording Transactions in the General Journal

Completing the Accounting Cycle Posting Journal Entries to General Ledger Accounts

The Six-Column Worksheet

Financial Statements for a Sole Proprietorship

Completing the Accounting Cycle

Cash

Control and the Payroll System

Banking Procedures • Define cash control.

Reconciling the Bank Statement

Calculating Gross Earnings

Payroll Deductions

Payroll Records

Journalizing and Posting Payroll

Employer’s Payroll Taxes

Tax Liability Payments and Tax Reports

Accounting and Ethics

Competencies

Foundations of Accounting

Students will demonstrate an understanding of foundations of accounting by explaining the function of accountants, describing the role of accounting, explaining the importance of ethics in accounting, and describing the role of accounting formulas and software.

Accounting Cycle Fundamentals

Students will demonstrate an understanding of accounting cycle fundamentals by describing types of claims and transactions, explaining the Impact of transactions, explaining the rules of debit and credit, and describing the role of the double-entry accounting system.

Accounting Cycle Process

Students will demonstrate an understanding of the accounting cycle process by describing the process of posting journal entries, explaining the function of financial statements, and explaining the impact of closing entries.

Cash Control and Payroll System Fundamentals

Students will demonstrate an understanding of cash control and payroll system fundamentals by describing the elements of banking, explaining payroll tasks and procedures, and describing types of employment taxes.

Ethical Accounting Standards

Students will demonstrate an understanding of ethical accounting strategies by explaining the role of the problem statement, describing the process of investigation, and describing factors leading to solutions.